Understanding the Surge in Capacity Rates and Its Impact on Energy Costs

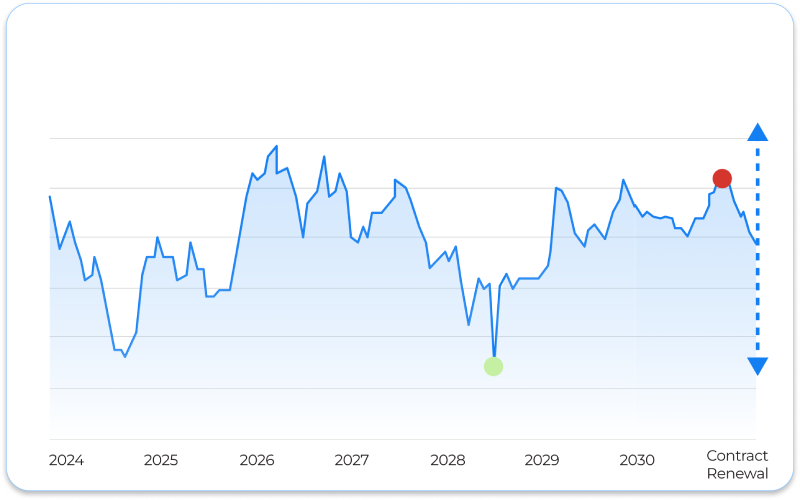

In July 2024, PJM Interconnection conducted its annual capacity auction for the 2025–2026 planning year, resulting in a substantial increase in capacity prices—from $28.92/MW-day to $269.92/MW-day—a more than 800% surge.

This dramatic rise is attributed to several key factors that have significant implications for businesses' energy expenditures.

Factors Contributing to the Capacity Rate Increase:

- Enhanced Non-Performance Penalties: Following widespread generator failures during Winter Storm Elliott in 2022, PJM imposed stricter penalties for non-performance to ensure grid reliability. These heightened financial risks led to a reduction in generator participation in the capacity auction, thereby decreasing supply and elevating prices.

- Escalating Electricity Demand: The growing adoption of data centers, electric vehicles, and all-electric buildings has led to a significant uptick in electricity consumption. To accommodate this surge, PJM increased its capacity procurement, further driving up costs.

- Reduced Contributions from Renewable Energy Sources: PJM adjusted the capacity valuations for renewable generators, such as wind and solar, to more accurately reflect their intermittent nature. Consequently, these resources could offer less capacity in the auction, diminishing overall supply and contributing to higher prices.

Implications for Businesses:

The escalation in capacity rates is projected to increase electricity costs by approximately ~1 cent per kilowatt-hour, translating to a 5–10% rise in overall energy expenses. This underscores the importance for businesses to adopt strategic energy management practices, including enhancing energy efficiency and exploring alternative procurement strategies, to mitigate the financial impact of these rising costs.

Sources: